What are the Best TimeFrames For Trading Forex ?

To get the most profit from paper trading, an investment decision and the placing of trades should follow real trading practices and objectives. The paper investor should consider the same risk-return objectives, investment constraints, and trading horizon as they would use with a live account. For example, it would make little sense for a risk-averse investor to paper trade in the same way as a day trader and make numerous short-term trades. Scalping is one of the quickest strategies employed by active traders.

This makes it a popular trading style for those who have other commitments (such as a full-time job) and would like to trade in their leisure time. However, it is still necessary to dedicate a few hours a day to analyse the markets. As scalping can be intense, scalpers tend to trade one or two pairs.

Forex Daily Charts Strategy

Trend-following systems require a particular mindset, because of the long duration—during which time profits can disappear as the market swings—these trades can be more psychologically demanding. When markets are volatile, trends will tend to be more disguised and price swings will be greater. Therefore, a trend-following system is the best trading strategy for Forex markets that are quiet and trending. Typically, currency trend traders look for long term trends and relative movements in benchmark interest rates.

It can take several weeks to months or even years for the trend they have identified to fully unfold before liquidating their positions when they think the time is right. Trend Trading – the longest-term of the trading strategies, trend traders identify the overall trend in the market, establish a position and wait for the trend to play out.

This quote demonstrates both his willingness to cut a trade that is not working, and the high level of discipline that is shared by the most successful Forex traders. So George Soros is number 1 on our list as probably one of the best known ‘world’s most successful Forex traders’, and certainly one of the globe’s highest earners from a short term trade. A last ditch attempt to hike UK rates that had briefly hit 15% proved futile. When the UK announced its exit from the ERM, and a resumption of a free-floating pound, the currency plunged 15% against the Deutsche Mark, and 25% against the US dollar.

There are various methods used to accomplish an active trading strategy, each with appropriate market environments and risks inherent in the strategy. Here are four of the most common active trading strategies https://forexarticles.net/ and the built-in costs of each strategy. The theory is that after a major price move, subsequent levels ofsupport and resistance will occur close to levels suggested by the Fibonacci ratios.

In fact, Mr. Druckenmiller worked alongside him at the Quantum Fund for more than a decade. But Druckenmiller has established a formidable reputation in his own right, successfully managing billions of dollars for his own fund, Duquesne Capital. He can easily be considered as one of the best day traders in the world.

Hopefully this article has given you some insights into traits shared by the most successful Forex traders. Joining the list of traders who are able to consistently turn a profit each month trading FX is certainly an achievable goal. Here we see Soros’ strong appreciation of risk/reward – one of the facets https://forexarticles.net/investment-banking-valuation-leveraged-buyouts-and-mergers-and-acquisitions/ that helped carve his reputation as arguably, the best Forex trader in the world. Rather than subscribing to the traditional economic theory that prices will eventually move to a theoretical equilibrium, Soros deemed the theory of reflexivity to be more helpful in judging the financial markets.

Professional Forex Trading Tips

One of the reasons forex is so attractive is that traders have the opportunity to make potentially large profits with a very small investment—sometimes as little as $50. Properly used, leverage does provide the potential for growth.

- When the UK announced its exit from the ERM, and a resumption of a free-floating pound, the currency plunged 15% against the Deutsche Mark, and 25% against the US dollar.

- There are many types of forex software that can help you learn to trade the forex market.

- Planning, setting realistic goals, staying organized, and learning from both successes and failures will help ensure a long, successful career as a forex trader.

- The drawback to spread betting is that a trader cannot claim trading losses against his other personal income.

- First of all, trading is not a game, and you should never treat it as one.

- Day trading is popular among many traders in the forex market, as it allows the trader to have no open positions to worry about overnight.

Automated forex trading is a method of trading foreign currencies with a computer program. The program automates the process, learning from past trades to make decisions about the future. Although change can be good, changing a forex trading strategy too often can be costly. Traders should consider developing trading systems in programs like MetaTrader that make it easy to automate rule-following. In addition, these applications let traders backtest trading strategies to see how they would have performed in the past.

For those that are not comfortable with the intensity of scalp trading, but still don’t wish to hold positions overnight, day trading may suit. Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Paper trades teach novices how to navigate platforms and make trades, but may not represent real market conditions. The proliferation of online trading platforms has increased the ease and popularity of paper trading without the commitment of actual capital.

These time frames are typically known as the short, medium and long term time periods. Many traders do not place very much attention on the actual time frame that they intend to trade or how long they intend to hold a position for. They may set a stop loss and take profit order levels, but otherwise have no particular time frame in mind for closing out their position. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

In this post, I’ll answer the question of whether you can and should start trading Forex with $100. We’ll discuss the various account types and position sizes and I’ll also share some tips on how to determine the right account size. Even though dozens of economic releases happen each weekday in all time zones and affect all currencies, a trader does not need to be aware of all of them. It is important to prioritize news releases between those that need to be watched versus those that should be monitored.

Once a forex trader opens an account, it may be tempting to take advantage of all the technical analysis tools offered by the trading platform. While many of these indicators are well-suited to the forex markets, it is important to remember to keep analysis techniques to a minimum in order for them to be effective. Using multiples of the same types of indicators, such as two volatility indicators or two oscillators, for example, can become redundant and can even give opposing signals. The forex industry has much less oversight than other markets, so it is possible to end up doing business with a less-than-reputable forex broker.

When using a long term strategy, the trader can use a weekly chart to establish the long term trend and use the daily or 4 hour chart to better time the initiation of positions. Novice traders must also be made aware that the shorter the time frame they trade in, the more market volatility they can experience. The incidence of trading mistakes also tends to increase with trading frequency and the need for quick reaction times. New traders therefore should consider beginning to trade with a longer term outlook, since this will also generally reduce their trading frequency and teach them the importance of operating strategically. Once their trading methods have proven successful, they can then move on to dealing in the shorter time frames is they wish.

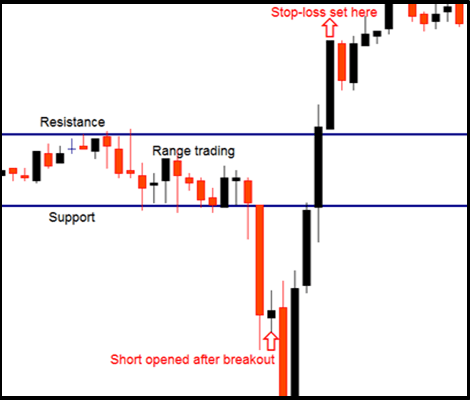

For instance, they may require that the price rebound from a specific support level by a certain percentage or number of pips. You can read more about technical indicators by checking out our education section Supply Chain Finance and Blockchain Technology: The Case of Reverse Securitisation or through the trading platforms we offer. The best forex trading strategies for beginners are the simple, well-established strategies that have worked for a hugelist of successful forex traders already.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider.You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This website includes information about cryptocurrencies, contracts for difference (CFDs) and other financial instruments, and about brokers, exchanges and other entities trading in such instruments. Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. You should carefully consider whether you understand how these instruments work and whether you can afford to take the high risk of losing your money.

You should not blame the market, or worry about your losing trades. As an alternative to focusing only on how to earn money in Forex, try to focus on learning a trading strategy and researching all the trading tools that are within your reach.

Over 100,000 traders have chosen Admiral markets as their broker, and it’s thanks to their continued faith in our product and offering that Admiral Markets has been given numerous awards. If you are worried about the financial security or reputation of your Forex broker, it can be difficult to focus on your trading. If, on the other hand, you have confidence in your Forex broker, this will free up mental space for you to devote more time and attention to analysis and developing FX strategies. Many traders believe that luck will not abandon them, but as everyone knows, luck is not infinite and one it runs out, it will create consistent losses. Therefore, it is important to reinforce healthy trading habits, as these will help you achieve your goal of becoming a successful Forex trader.